Magnite, the industry’s largest, independent supply-side platform (SSP), is launching ClearLine to provide advertisers and agencies direct access to top-shelf video inventory without having to use a demand-side platform (DSP).

ClearLine essentially allows advertisers to ‘cut out’ the DSP fee and helps them share their data to publisher data in a more privacy-compliant way. Magnite says it launched ClearLine in response to requests from media agencies asking for a more direct path to inventory. The solution was made possible by Magnite’s $31M acquisition of SpringServe, a connected TV (CTV) ad server that publishers used to manage their demand.

Magnite expects ClearLine to be used in specific scenarios based on media buyer demand, with DSPs remaining its primary source of revenue and the most common tool for advertisers and agencies to access its video inventory.

ClearLine’s launch partners include Camelot, MiQ, and GroupM; ClearLine provides access to the GroupM Premium Marketplace. If this approach sounds familiar, ClearLine in many ways mirrors OpenPath, a solution launched last year by The Trade Desk—the industry’s largest independent DSP—to give advertisers direct access to publisher inventory without the need for SSPs.

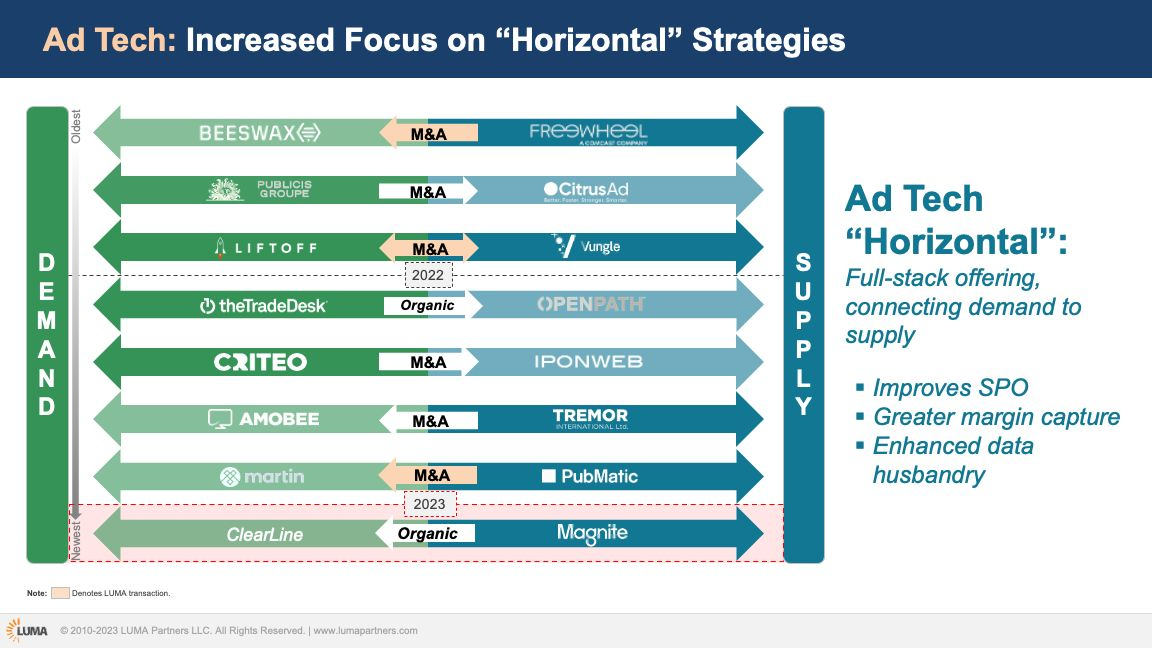

Opinion: The “horizontal” ad tech play (horizontal = connecting supply and demand in a single stack) is not new. DSPs have tried to become SSPs and vice versa throughout history (remember when SSP The Rubicon Project acquired retargeting DSP Chango in 2015?), and some have been very successful in doing so (see: Google and Amazon). It’s a way for companies to a) lower the “ad tech tax” for their customers and b) capture more margin. Historically, it’s been much easier for walled gardens to execute this “horizontal” playbook, as they have control over unique data and inventory, which they can use to force buyers and sellers into their ecosystem. It’s been harder for independents like The Trade Desk and Magnite. Doesn’t mean they won’t try when an opportunity presents itself.

The explosion of digital video and CTV presents such an opportunity for SSPs to go “horizontal,” because:

- Most CTV / video inventory is controlled by a select group of premium publishers that want to sell their inventory either directly to advertisers or through private deals, and private deals are setup in publisher’s SSP

- The DSP value prop (scale and universal audience activation) is heavily diminished when advertisers buy via private deals, so much so that DSPs drop their fees virtually by 50% for these deals

So why wouldn’t buyers cut out those DSP fees entirely and buy CTV / video directly from the SSPs?

Aside from cost savings, there’s also the secondary benefit of having capabilities in SSPs to manage inventory that DSPs just can’t offer: “The SSP is super close to the supply,” said Mike Treon, U of Digital Expert and head of CTV buying at Camelot— one of ClearLine’s launch partners—in an exclusive interview with U of Digital. “Their tools for delivery are built more for CTV than omnichannel DSPs that were built more for display. That includes, for example, buying based on genre, blocking specific channels and networks, and real-time impression delivery. When we make a change, we see the effects in less than 5 minutes in their dashboard.”

The big picture here is that SSPs will try to be DSPs and DSPs will try to be SSPs endlessly, and some may succeed while others won’t. We may be in a perfect environment for this right now due to the financial crunch, where every last dollar saved matters a ton, and agnosticism to either side of the ecosystem matters a lot less. This is the ebb and flow of the industry, which repeatedly oscillates between consolidation and fragmentation. It feels like we’re entering into a phase of consolidation.

Discover more from FAST Broadcaster

Subscribe to get the latest posts to your email.