The headline ‘Publishers Receive ZERO Percent in Programmatic Deals’ seems too sensational to be true, and one might dismiss it as mere clickbait. But hold on, there’s more to it.

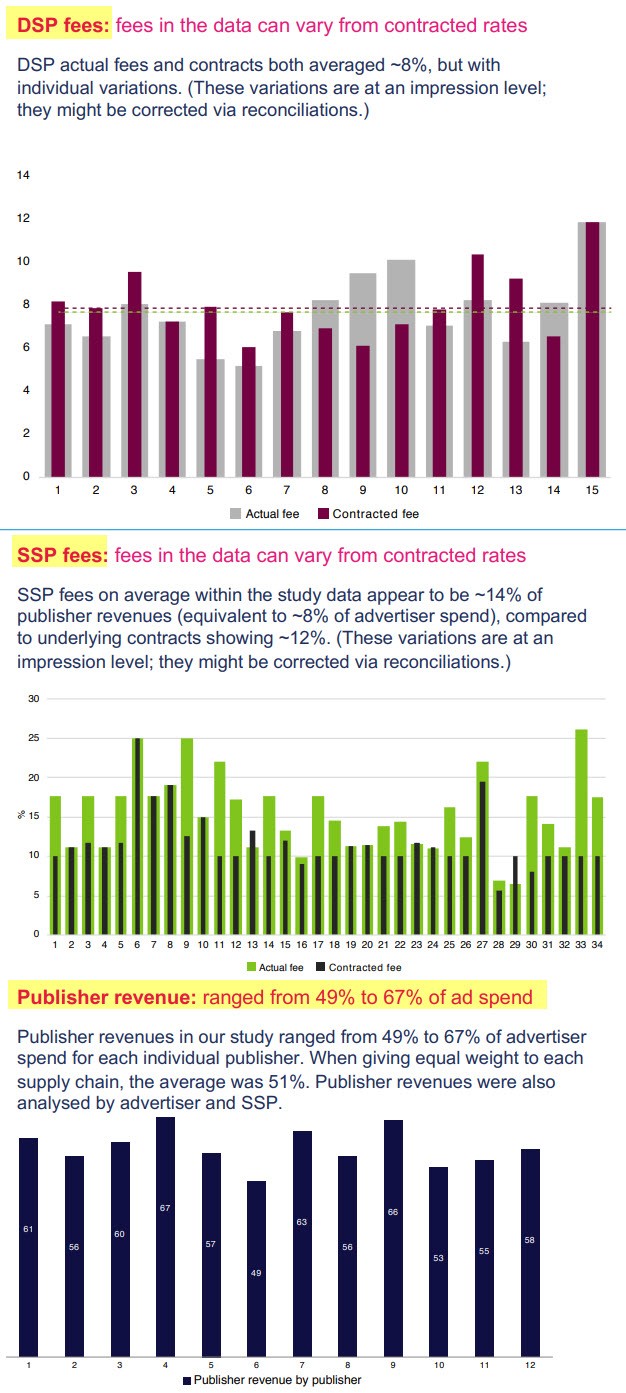

The two ISBA studies from 2019 and 2022 are well-known, revealing that publishers, in the most favorable circumstances, receive only half of every advertising dollar. That is, for each dollar spent by advertisers on programmatic advertising, publishers see only 50 cents for displaying those ads. However, as is commonly understood, averages can mask the stark reality. A detailed examination of the data on DSP fees, SSP fees, and Publisher Revenue reveals a greater disparity in the figures.

The data from the ISBA studies, which encompassed only the biggest advertisers and publishers—akin to the most ‘transparent’ sectors—indicate that fees generally align with the agreed-upon contracts. Yet, the inaugural ISBA study uncovered a perplexing ‘unknown delta’ of 15 percent, a portion of the expenditures that remained untraceable. This subtly suggests the presence of concealed fees and other dubious practices that eluded clear identification throughout the supply chain.

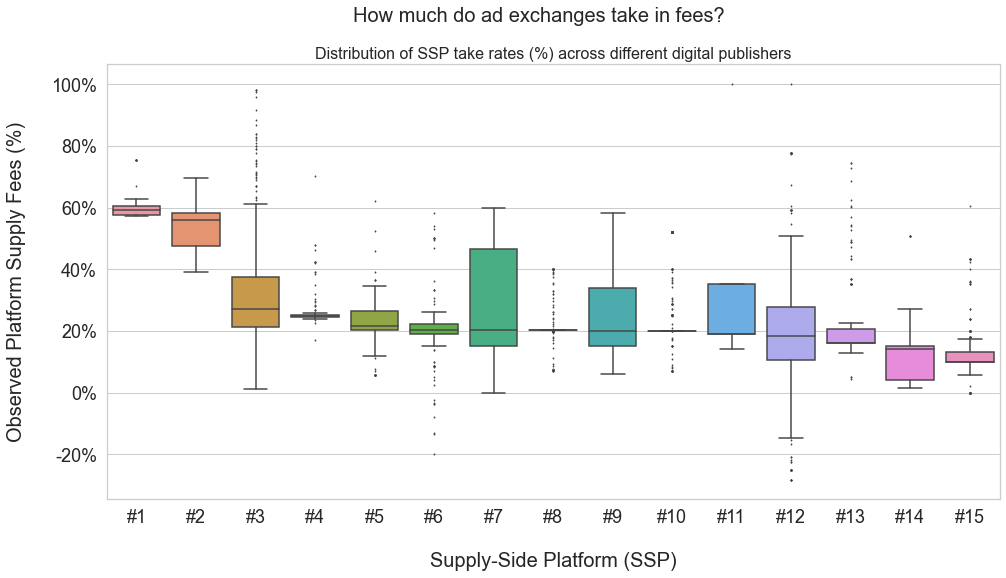

Turning our attention to further research on ‘take rates,’ a graph from Adalytics.io reveals that the average take rates for SSPs lie between 20 and 30 percent. However, it’s noteworthy that SSP #3 exhibits take rates as high as 99 percent. Despite its self-promotion as an SSP dedicated to aiding small publishers in enhancing their programmatic ad earnings, it appears that this SSP is, in fact, prioritizing its own profit over the interests of the very clients it claims to support.

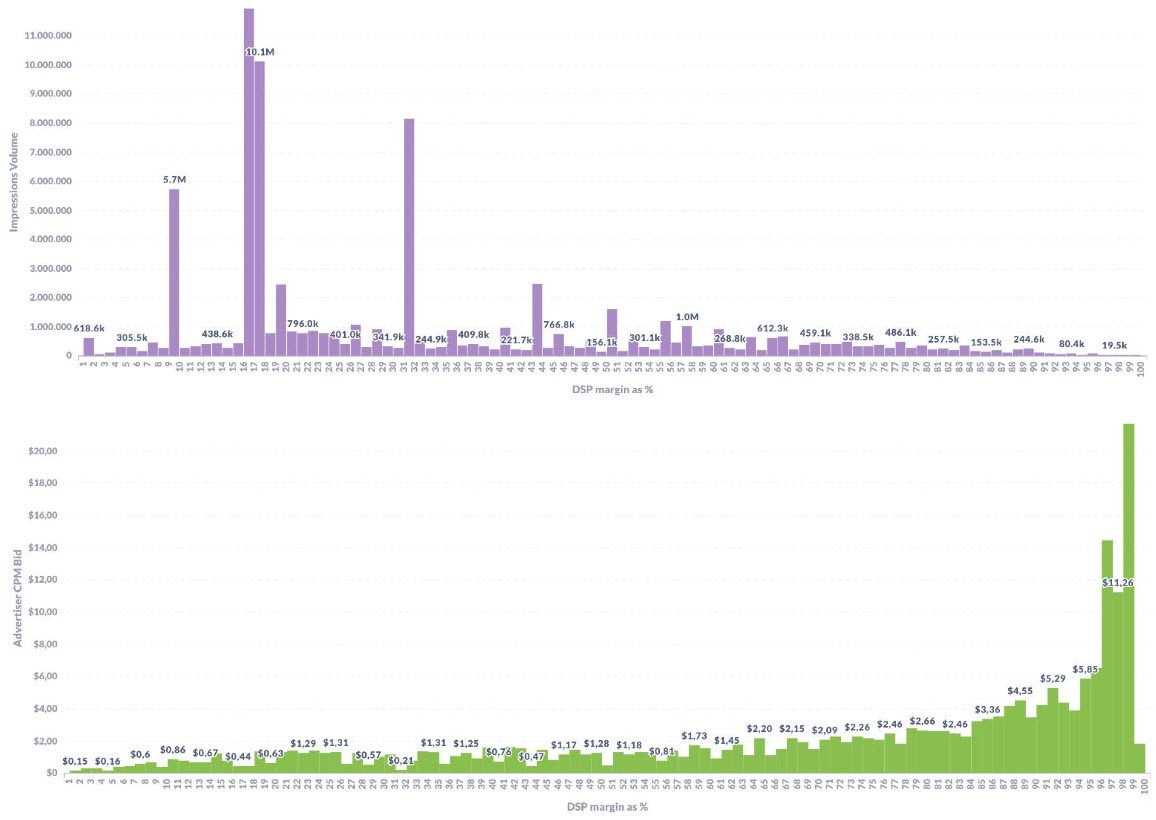

Recent findings from AIDEM have brought to light the take rates of DSPs. The initial graph, depicted in purple, illustrates the distribution of ad volumes across various DSP take rates (margin percentages).

The most significant concentrations are observed at 16 – 18% and then at 31-32%. However, the subsequent graph, presented in green, is particularly intriguing as it correlates the DSP margin with the CPM bid by advertisers. The peculiar aspect here is the direct relationship between the bid CPM and the DSP’s margin—higher bids result in greater margins for the DSP.

This is evident on the far right of the green bar graph, where the DSP’s margin percentage approaches 100% at the highest ‘Advertiser CPM Bid’. In essence, this implies that as advertisers increase their bids, the DSP’s earnings escalate correspondingly, while the publishers, who are downstream from the DSP, earn the same or potentially less, despite the advertiser’s higher bid and payment for CPMs.

This occurs because the DSP absorbs the entirety of the increment.

This aligns with my own observations from various experiments over time, particularly one detailed in a 2020 article titled “Truly Valuable (Expensive) Lesson Learned.” For three years, I conducted an ongoing experiment with a 1 cent CPM campaign, keeping a record of the fraud levels on substandard sites and apps. Curious about the impact of a higher bid, I increased my offer to $1 CPM—a hundredfold jump—to see the outcome. The full account, including site and app lists, is in the article, but here’s the gist: there was no change. The quality of sites and apps remained the same at $1 CPM as it did at 1 cent CPM, and the fraud rates were consistent. This suggests that fraudulent sites are indifferent to the CPM offered, be it 1 cent or 1 dollar. On the flip side, reputable publishers using programmatic channels don’t see an increase in revenue from higher CPMs due to the larger cuts taken by intermediaries.

Considering all the data: 1) SSPs can take as much as 99%, 2) DSPs can also take up to 99%, and 3) neither fraud rates nor the mix of sites and apps improve with a 100-fold increase in CPMs, what’s the conclusion?

As an advertiser, I’d conclude that no matter the CPM paid, or whether purchases are made through a private marketplace, buying via programmatic channels likely means not receiving full value for money. For publishers, it would mean that regardless of the CPM paid by advertisers, selling through programmatic channels results in most of the revenue going to intermediaries, often without their knowledge. Thus, even selling remnant inventory programmatically isn’t worthwhile. It further damages the market as buyers may wait for inventory to become remnant, expecting to acquire it at rock-bottom prices.

What’s the alternative? Platforms like DanAds and AIDEM offer a more direct purchasing route from publishers, with only their fees as an intermediary cost. This approach reduces the number of middlemen, curtails ad fraud and other losses from excessive supply paths, and also lessens the environmental impact by cutting down on the unnecessary computational power and bandwidth used in RTB (real-time bidding). It’s time to transition to a post-cookie and post-RTB era, benefiting both the planet and the effectiveness of digital ad investments.

Here’s how some advertisers have started their transition to the post-cookie, post-RTB world: https://www.linkedin.com/pulse/advertisers-path-forward-post-cookie-post-rtb-digital-fou

Thank you Dr Augustine Fou

Discover more from FAST Broadcaster

Subscribe to get the latest posts to your email.